The evolution of the financial crisis that emerged in 2007, peaked in the autumn of 2008 and began to wind down in 2009 has been accurately predicted based on the SAMVA USA chart. Actually, the predictions pretty much "nailed it." The following timeline of the financial crisis and predictions made demonstrate this in a convincing manner.

The evolution of the financial crisis that emerged in 2007, peaked in the autumn of 2008 and began to wind down in 2009 has been accurately predicted based on the SAMVA USA chart. Actually, the predictions pretty much "nailed it." The following timeline of the financial crisis and predictions made demonstrate this in a convincing manner.EMERGENCE OF CRISIS

On January 6, 2007, one of the first predictions was made on the basis of the SAMVA USA chart. In it, "financial/market setbacks" were predicted for the Spring of 2007. The sub-prime crisis that erupted in early 2007 is considered the beginning of the financial crisis that peaked in 2008 and started to ease in early 2009.

February–March 2007

Subprime industry collapse; several subprime lenders declaring bankruptcy, announcing significant losses, or putting themselves up for sale. [1]

[Side note: In late December 2006, "violence" and "loss of life" was also predicted for the USA in the Spring. On April 16, 2007, thirty two people lost their lives in the Virginia Tech Massacre that gripped the national attention].

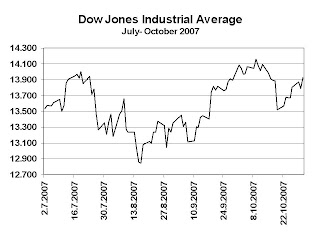

While the related problems in the late summer of 2007, which manifest most strongly in Germany and China, were not predicted based on the SAMVA USA chart, they are consistent with the transit-period dynamics of the chart at that time. The stock market, which had reached a new high in July 2007, quickly recovered from the August dip and reached a market top at above 14,000 in October of that year.

August 2007

Worldwide "credit crunch" as subprime mortgage backed securities are discovered in portfolios of banks and hedge funds around the world, from BNP Paribas to Bank of China. Federal Reserve injects about $100 billion into the money supply for banks to borrow at a low rate.

Worldwide "credit crunch" as subprime mortgage backed securities are discovered in portfolios of banks and hedge funds around the world, from BNP Paribas to Bank of China. Federal Reserve injects about $100 billion into the money supply for banks to borrow at a low rate.In an article The year ahead for the USA on December 31, 2007 the nature of the emerging crisis was explained in terms of the Venus- Jupiter period, as Venus, 4th lord of housing is badly placed and weak in the 6th house of financial stability in the SAMVA USA chart, which is ruled by Jupiter. As a result "the acquisition of homes or vehicles is based on debt and this can become a source of conflict or problems, such as in mortgage debt defaults."

In an article The troublesome transit of Mars in Gemini on January 5, 2008 the following was noted:

"On January 1, 2008, astrologer & author V. K. Choudhry made the following prediction on the SAMVA list: "Transit Mars is going to be under continuous affliction of transit Rahu for next couple of weeks. This close affliction, in general, gives rise to ...volatility to financial markets and stress to executives."

The following was also mentioned:

"In late January and early February 2008, Mars will be at almost 0° in Gemini where it is utterly powerless. Hence, the dynamism of the indications of Mars will be at a low ebb. Fortunately, the aspect of Rahu is not as close at these times, but felt nonetheless. However, when Mars turns direct and advances back into Gemini, it will come under the aspect of Rahu again at 3° 42' around February 25, 2008. At that time, the disruption in the stock market could again be felt more strongly. In the SAMVA USA chart, the transit of Mars in Gemini is especially difficult as this sign falls in the 12th house of the chart. The 12th house is one of the three malefic houses, ruling "financial losses, expenditure, mishaps, group hospitalizations, foreign debt, wars and smuggling."

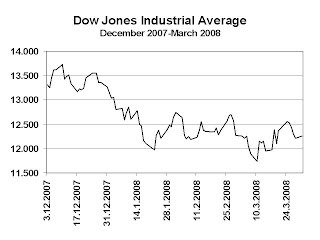

What happened? In the first three months of 2008 the problems in the financial system increased considerably and became quite difficult, but the situation remained broadly manageable.

January 2008

January 2–21: Stock market downturn.

January 2–21: Stock market downturn.January 24: National Association of Realtors announces largest drop in existing home sales in 25 years in 2007, and "the first price decline in many, many years and possibly going back to the Great Depression."

March 2008

March 14: Bear Stearns gets Fed funding as shares plummet.

March 16: Bear Stearns is acquired for $2 a share by JPMorgan Chase in a fire sale avoiding bankruptcy. The deal is backed by the Federal Reserve, providing up to $30B to cover possible Bear Stearn losses.

PEAK OF CRISIS

More importantly, in the December 2007 article The year ahead for the USA a "crisis in the fall [of 2008]" was predicted. Specifically, "the astrological situation will become decidedly more intense from late July. At that time, the Moon´s nodes. Rahu and Ketu, will go into stationary motion over the natal Sun in the chart at 23° 44' Capricorn in the 7th house. At that time, problems or stress will be felt from ... the wealth of the country (possibly having to do with a reduction in the value of the dollar or stocks), or difficulty for the President. This aspect peaks at the end of September and the situations that arise are expected to gradually ease in the following weeks."

In the article More financial market volatility in 2008 on February 2, 2008 the timing and nature of the difficulties seen ahead was further elaborated:

August-September 2008

- transit Jupiter at 18° Sagittarius H6 aspects transit Saturn at 18° Leo H2. This aspect, which takes place in the most effective point of the SAMVA USA chart, is expected to bring renewed volatility in financial markets.

- natal Rahu at 18° Aries aspects transit Jupiter and Saturn. This transit is linked to the above aspect, making it worse. It suggests a crisis surrounding manipulation in order to obtain easy gains. Leaders in the financial industry... may face a difficult time.

Things remained fairly benign on the surface through August 2008. It was. however, in September 2008 that all hell broke lose on the financial markets. That month had been signalled as the peak of difficulty as per the transit contacts. Leaders in the financial industry were hit with the worst financial crisis in 70 years, with many losing their firms, jobs and reputations.

September 2008

September 7: Federal takeover of Fannie Mae and Freddie Mac, which at that point owned or guaranteed about half of the U.S.'s $12 trillion mortgage market, effectively nationalizing them.

September 7: Federal takeover of Fannie Mae and Freddie Mac, which at that point owned or guaranteed about half of the U.S.'s $12 trillion mortgage market, effectively nationalizing them.September 14: Merrill Lynch is sold to Bank of America amidst fears of a liquidity crisis and Lehman Brothers collapse

September 15: Lehman Brothers files for bankruptcy protection. This event is seen as the peak of the crisis, as it paralyzed inter-bank lending; leading to a seizing up of the global financial system.

September 17: US Federal Reserve lends $85 billion to American International Group (AIG) to avoid bankruptcy.

September 18: Treasury Secretary Henry Paulson and Fed Chairman Ben Bernanke meet with key legislators to propose a $700 billion emergency bailout through the purchase of toxic assets. Bernanke tells them: "If we don't do this, we may not have an economy on Monday."

September 19: Paulson financial rescue plan is unveiled after a volatile week in stock and debt markets.

While things continued very difficult in the first half of October 2008, the situation began to gradually stabilise, not least due to the significant policy actions taken by the authorities to prevent a meltdown of the financial system. The prediction in late 2007 for the "financial system to remain functioning" despite the crisis was also proved correct.

October 2008

October 3: President George W. Bush signs the Emergency Economic Stabilization Act, creating a $700 billion Troubled Assets Relief Program to purchase failing bank assets.

October 6-10: Worst week for the stock market in 75 years. The Dow Jones loses 22.1 percent, its worst week on record, down 40.3 percent since reaching a record high of 14,164.53 October 9, 2007. Fed announces that it will provide $900 billion in short-term cash loans to banks and makes emergency move to lend around $1.3 trillion directly to companies outside the financial sector. Central banks in USA (Fed), England, China, Canada, Sweden, Switzerland and the European Central Bank cut rates in a coordinated effort to aid world economy. Fed also reduces its emergency lending rate to banks by half a percentage point, to 1.75 percent.

October 11: Central bankers and finance ministers from the Group of Seven (G-7) leading economies, meet in Washington and agree to urgent and exceptional coordinated action to prevent the credit crisis from throwing the world into depression.

October 14: The US taps into the $700 billion available from the Emergency Economic Stabilization Act and announces the injection of $250 billion of public money into the US banking system. Nine banks agreed to participate in the program.

GRADUAL END OF CRISIS

The prediction for the end of the year also suggested considerable difficulty.

"Further, the time in late November will be especially difficult as transit Saturn will then also be under the aspect of natal Saturn in the chart, heightening the potential for violence and the destruction of assets."

November 2008

November 15: Group of 20 of the world’s largest economies (G-20) meets in Washington DC and releases a statement focusing on the implementation of policies consistent with five principles: strengthening transparency and accountability, improving regulation, promoting market integrity, reinforcing cooperation and reforming international institutions.

November 17: The Treasury gives out $33.6 billion to 21 banks in the second round of disbursements from the $700 billion bailout fund. This payout brings the total to $158.56 billion so far.

November 24: US government agrees to rescue Citigroup after an attack by investors causes the stock price to plummet 60% over the last week under a detailed plan that including injecting another $20 billion of capital into Citigroup bringing the total infusion to $45 billion.

November 25: The US Federal Reserve pledges $800 billion more to help revive the financial system. $600 billion will be used to buy mortgage bonds issued or guaranteed by Fannie Mae, Freddie Mac, and Fannie Mae, and the Federal Home Loan Banks.

December 2008

December 11, 2008: Bernard Madoff, Chairman of Wall Street firm Bernard L. Madoff Investment Securities LLC, arrested for bilking investors out of an estimated $20 billion in a Ponzi scheme that might be "the largest investment fraud in Wall Street history."

[Side note: The Covina massacre occurred on December 24, 2008, in a suburb of Los Angeles, California. Nine people were killed from either gunshot wounds or an arson fire inside a house where a Christmas Eve party was being held. The Saturn aspect was still close.]

Astrologer & author V.K. Choudhry predicted on SAMVA list in 2008 that the financial market turmoil would diminish from December 2008 and more so after February 2009. It is clear that this prediction has been realised. In October 2009, the Dow Jones Industrial Average again exceeded 10,000.

January-February 2009

The worst start to a year in the history of the S&P 500 with a drop in value of 19%.

February 17: Allen Stanford charged by the U.S. Securities and Exchange Commission with "massive ongoing fraud" involving $8 billion in certificates of deposits.

March 2009

March 8: Blackstone Group CEO Stephen Schwarzman says that up to 45% of global wealth has been destroyed by the global financial crisis.

March 8: Blackstone Group CEO Stephen Schwarzman says that up to 45% of global wealth has been destroyed by the global financial crisis.March 9: the Dow Jones Industrial Average Index falls to 6,440. The decline is compared to that of the 1929 Great Depression.

March 10: Rally begins, taking the Dow up to 8,500 by early May 2009 and over 10,000 in October 2009.

In the article The banking crisis of 2008 and the SAMVA USA chart on March 17, 2008 the following was predicted:

"The outlook for the economy is not very good for the next few years. The dynamics will also shift in the sub-period of Saturn as 8th lord from February 2009. The conditions in the US economy have ramifications for economic growth around the planet. Saturn natally afflicts the 2nd lord of wealth, Sun, in the SAMVA USA chart, such that it can both confer easy gains or lead to losses of wealth. At the beginning of the Saturn sub-period, a difficult aspect will be coming to an end involving the affliction of natal Saturn to transit Saturn (Nov '08-Feb '09). This transit can bring ...problems for easy gains or wealth. Finally, as the Venus period lasts until 2016, the issues having to do with housing and financial stability will continue to be felt for some years. However, it is likely that the major difficulty will be experienced in 2008, while the Jupiter sub-period is still operating. This is because of the natal link between Jupiter and Venus, due to the placement of Venus in the sign Sagittarius, owned by Jupiter."

In the article Greed and fear in astrology on December 26, 2008 it was mentioned that the "[SAMVA USA chart] indicates that the economic recovery will be slow in coming."

Further, in the article Predictions for the USA in 2009 on December 31, 2008 the following was stated that during the Saturn sub-period lasting from February 17, 2009 to April 19, 2012 "the economy may become sluggish."

In September and October 2009 the data suggest a recovery is taking place in the US economy, even if unemployment is expected to continue rising for some time.

While further financial market volatility is possible at this time, it is expected to be short lived and be more focused on the burgeoning debt of the USA in terms of the low value of the dollar and rising interest rates on US debt. This was explained in the article Astrology of increasing public debt published on March 21, 2009.

Conclusion

It is clear the predictions based on the SAMVA USA chart were pretty accurate when it comes to both the nature and timing of the events. This is further evidence for this being the authentic national horoscope for the USA.

Notes

[1] Wikipedia: Subprime crisis impact timeline

http://en.wikipedia.org/wiki/Subprime_crisis_impact_timeline

No comments:

Post a Comment