After simmering and building for a number of years, a dramatic financial crisis erupted in the USA in the Autumn of 2008. This development was predicted based on the SAMVA USA chart (Perpetual Union) as further documented on the SAMVA discussion list on Yahoo and on this blog. A configuration is seen in the US chart which is consistent with manipulation in commercial dealings involving debt having implications for others. Indeed, an economic and financial crisis has also been predicted for other countries based on their authentic charts. The financial crisis that developed in the USA has become global in reach.

After simmering and building for a number of years, a dramatic financial crisis erupted in the USA in the Autumn of 2008. This development was predicted based on the SAMVA USA chart (Perpetual Union) as further documented on the SAMVA discussion list on Yahoo and on this blog. A configuration is seen in the US chart which is consistent with manipulation in commercial dealings involving debt having implications for others. Indeed, an economic and financial crisis has also been predicted for other countries based on their authentic charts. The financial crisis that developed in the USA has become global in reach. The cause of the present economic crisis

The cause of the global financial market crisis was a major US housing boom which came to an eventual end with financial institutions incurring significant losses on mortgages and mortgage related assets. The global credit boom was characterised by a broad underpricing of risk, excessive leverage of financial institutions and increasing reliance on complex and opaque financial instruments which proved to be fragile under stress. Essentially, there was a failure to regulate and supervise the quality of new mortgages being issued in the USA. Various originators and distributors of mortgage debt used creative approaches to fool large institutional investors by obscuring the significant risks involved while over-emphasising the high returns. The lending proved to be loss making or entailing high risk of loss. A significant part of US mortgages issued in recent years was “toxic” and was sold around the world with ramifications for banking behaviour everywhere. Hardly any bank is willing to lend to another bank anymore, especially when it involves the exchange of securities, which has been a pillar of inter-bank lending. An important questions that begs an answer is what explains such wholesale manipulation in financial activities?

The cause of the global financial market crisis was a major US housing boom which came to an eventual end with financial institutions incurring significant losses on mortgages and mortgage related assets. The global credit boom was characterised by a broad underpricing of risk, excessive leverage of financial institutions and increasing reliance on complex and opaque financial instruments which proved to be fragile under stress. Essentially, there was a failure to regulate and supervise the quality of new mortgages being issued in the USA. Various originators and distributors of mortgage debt used creative approaches to fool large institutional investors by obscuring the significant risks involved while over-emphasising the high returns. The lending proved to be loss making or entailing high risk of loss. A significant part of US mortgages issued in recent years was “toxic” and was sold around the world with ramifications for banking behaviour everywhere. Hardly any bank is willing to lend to another bank anymore, especially when it involves the exchange of securities, which has been a pillar of inter-bank lending. An important questions that begs an answer is what explains such wholesale manipulation in financial activities?

On the nature of financial busts

More importantly, the unwinding of the boom and associated losses have led to a deleveraging of risk and an associated credit squeeze for households and businesses. The contraction in the volume of credit is the principal cause of the global economic slowdown. The reason for the shift in the volume of credit, from growth to contraction, is linked to credit booms being unsustainable. In the credit boom, asset values rise, increaing the equity of firms and households. In turn, with expanding wealth firms and households increase their borrowing and leverage increases in the financial system. At a given point, the volume of debt turns out to be excessive and unsustainable due to overinvestment and declining profits. At this point, asset prices, notably housing prices, begin to retreat. This puts financial insitutions under great strain and a process of deleveraging takes place as they become risk averse and credit growth turns negative. At the present juncture, the magnitude of the problems has resulted in bankruptcies of major banks around the world and credit supply drying up. In mid September, when the US investment bank Lehman Brothers collapsed, the inter-bank market seized up. Governments have subsequently stepped in and recapitalised banks with public funds, effectively nationalising them.

More importantly, the unwinding of the boom and associated losses have led to a deleveraging of risk and an associated credit squeeze for households and businesses. The contraction in the volume of credit is the principal cause of the global economic slowdown. The reason for the shift in the volume of credit, from growth to contraction, is linked to credit booms being unsustainable. In the credit boom, asset values rise, increaing the equity of firms and households. In turn, with expanding wealth firms and households increase their borrowing and leverage increases in the financial system. At a given point, the volume of debt turns out to be excessive and unsustainable due to overinvestment and declining profits. At this point, asset prices, notably housing prices, begin to retreat. This puts financial insitutions under great strain and a process of deleveraging takes place as they become risk averse and credit growth turns negative. At the present juncture, the magnitude of the problems has resulted in bankruptcies of major banks around the world and credit supply drying up. In mid September, when the US investment bank Lehman Brothers collapsed, the inter-bank market seized up. Governments have subsequently stepped in and recapitalised banks with public funds, effectively nationalising them.

Wither capitalism?

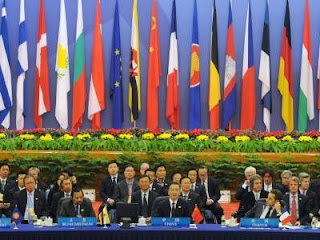

The financial crisis and global economic slowdown has led to increased reaction of policy authorities to supplement the evaporation of private credit lines with public funds. There has also been global policy coordination to meet the liquidity needs of increasingly globalised financial markets. The question now is if the actions will be sufficient to deal with the crisis. At a G-20 meeting in the USA this weekend, the leaders of major powers disucss the problems at a more fundamental level [1]. For US President Bush, the crisis is one of limited failures of an otherwise good system. He states that there is nothing fundamentally wrong with the free-market system and that what is needed are changes to the regulatory and oversight systems. Other leaders, like Nicholas Sarkozy of France and Paul Rudd of Australia, think more fundamental changes to markets are warranted including increased government intervention in the market place. This debate will likely intensify at the grass-roots level in coming months and year as the slump deepens and becomes more difficult for ordinary citizens.

The use of astrology in making predictions

Astrology can help when based on authentic birth charts of countries, effective methods of interpretation and prediction and the proper assessment of the astrologer. Accurate predictions on the basis of the authentic charts of the USA and UK in this regard have been documented. That said, the extent of the dramatic events of the financial crisis has come as a surprise to most observers. The change in conditions has been so significant as to draw comparisons with major such crises of the past.

Astrology can help when based on authentic birth charts of countries, effective methods of interpretation and prediction and the proper assessment of the astrologer. Accurate predictions on the basis of the authentic charts of the USA and UK in this regard have been documented. That said, the extent of the dramatic events of the financial crisis has come as a surprise to most observers. The change in conditions has been so significant as to draw comparisons with major such crises of the past.

The cause of the global financial market crisis was a major US housing boom which came to an eventual end with financial institutions incurring significant losses on mortgages and mortgage related assets. The global credit boom was characterised by a broad underpricing of risk, excessive leverage of financial institutions and increasing reliance on complex and opaque financial instruments which proved to be fragile under stress. Essentially, there was a failure to regulate and supervise the quality of new mortgages being issued in the USA. Various originators and distributors of mortgage debt used creative approaches to fool large institutional investors by obscuring the significant risks involved while over-emphasising the high returns. The lending proved to be loss making or entailing high risk of loss. A significant part of US mortgages issued in recent years was “toxic” and was sold around the world with ramifications for banking behaviour everywhere. Hardly any bank is willing to lend to another bank anymore, especially when it involves the exchange of securities, which has been a pillar of inter-bank lending. An important questions that begs an answer is what explains such wholesale manipulation in financial activities?

The cause of the global financial market crisis was a major US housing boom which came to an eventual end with financial institutions incurring significant losses on mortgages and mortgage related assets. The global credit boom was characterised by a broad underpricing of risk, excessive leverage of financial institutions and increasing reliance on complex and opaque financial instruments which proved to be fragile under stress. Essentially, there was a failure to regulate and supervise the quality of new mortgages being issued in the USA. Various originators and distributors of mortgage debt used creative approaches to fool large institutional investors by obscuring the significant risks involved while over-emphasising the high returns. The lending proved to be loss making or entailing high risk of loss. A significant part of US mortgages issued in recent years was “toxic” and was sold around the world with ramifications for banking behaviour everywhere. Hardly any bank is willing to lend to another bank anymore, especially when it involves the exchange of securities, which has been a pillar of inter-bank lending. An important questions that begs an answer is what explains such wholesale manipulation in financial activities?On the nature of financial busts

More importantly, the unwinding of the boom and associated losses have led to a deleveraging of risk and an associated credit squeeze for households and businesses. The contraction in the volume of credit is the principal cause of the global economic slowdown. The reason for the shift in the volume of credit, from growth to contraction, is linked to credit booms being unsustainable. In the credit boom, asset values rise, increaing the equity of firms and households. In turn, with expanding wealth firms and households increase their borrowing and leverage increases in the financial system. At a given point, the volume of debt turns out to be excessive and unsustainable due to overinvestment and declining profits. At this point, asset prices, notably housing prices, begin to retreat. This puts financial insitutions under great strain and a process of deleveraging takes place as they become risk averse and credit growth turns negative. At the present juncture, the magnitude of the problems has resulted in bankruptcies of major banks around the world and credit supply drying up. In mid September, when the US investment bank Lehman Brothers collapsed, the inter-bank market seized up. Governments have subsequently stepped in and recapitalised banks with public funds, effectively nationalising them.

More importantly, the unwinding of the boom and associated losses have led to a deleveraging of risk and an associated credit squeeze for households and businesses. The contraction in the volume of credit is the principal cause of the global economic slowdown. The reason for the shift in the volume of credit, from growth to contraction, is linked to credit booms being unsustainable. In the credit boom, asset values rise, increaing the equity of firms and households. In turn, with expanding wealth firms and households increase their borrowing and leverage increases in the financial system. At a given point, the volume of debt turns out to be excessive and unsustainable due to overinvestment and declining profits. At this point, asset prices, notably housing prices, begin to retreat. This puts financial insitutions under great strain and a process of deleveraging takes place as they become risk averse and credit growth turns negative. At the present juncture, the magnitude of the problems has resulted in bankruptcies of major banks around the world and credit supply drying up. In mid September, when the US investment bank Lehman Brothers collapsed, the inter-bank market seized up. Governments have subsequently stepped in and recapitalised banks with public funds, effectively nationalising them.Wither capitalism?

The financial crisis and global economic slowdown has led to increased reaction of policy authorities to supplement the evaporation of private credit lines with public funds. There has also been global policy coordination to meet the liquidity needs of increasingly globalised financial markets. The question now is if the actions will be sufficient to deal with the crisis. At a G-20 meeting in the USA this weekend, the leaders of major powers disucss the problems at a more fundamental level [1]. For US President Bush, the crisis is one of limited failures of an otherwise good system. He states that there is nothing fundamentally wrong with the free-market system and that what is needed are changes to the regulatory and oversight systems. Other leaders, like Nicholas Sarkozy of France and Paul Rudd of Australia, think more fundamental changes to markets are warranted including increased government intervention in the market place. This debate will likely intensify at the grass-roots level in coming months and year as the slump deepens and becomes more difficult for ordinary citizens.

The use of astrology in making predictions

Astrology can help when based on authentic birth charts of countries, effective methods of interpretation and prediction and the proper assessment of the astrologer. Accurate predictions on the basis of the authentic charts of the USA and UK in this regard have been documented. That said, the extent of the dramatic events of the financial crisis has come as a surprise to most observers. The change in conditions has been so significant as to draw comparisons with major such crises of the past.

Astrology can help when based on authentic birth charts of countries, effective methods of interpretation and prediction and the proper assessment of the astrologer. Accurate predictions on the basis of the authentic charts of the USA and UK in this regard have been documented. That said, the extent of the dramatic events of the financial crisis has come as a surprise to most observers. The change in conditions has been so significant as to draw comparisons with major such crises of the past. A comparison of depressions

The Great Depression of the 1930s was a classic tale of hubris and fall, when the Roaring Twenties came to a crashing end in late October 1929. The RAHU major period was operating in the SAMVA USA chart from April 19, 1919 to April 19, 1937. Rahu can bring spectacular material gain when strongly influencing in a chart. However, usually the gains are obtained through some form of manipulation which then turns out to be not durable. Such gains tend to be taken away, leaving those involved disillusioned. In the chart, Rahu is natally conjunct the most effective point of the 10th house, from where it afflicts also the 2nd house of wealth, the 4th house of fixed assets, the 6th house of debts and financial stability. Following the relatively auspicious sub-period of Mercury, the adverse sub-period of Ketu began on October 19, 1929, at a time when the transit nodes were afflicting their natal placements and houses. At that time, a sudden calamity erupted on the US stock market, ushering in years of painful adjustment in the economy.

The Great Depression of the 1930s was a classic tale of hubris and fall, when the Roaring Twenties came to a crashing end in late October 1929. The RAHU major period was operating in the SAMVA USA chart from April 19, 1919 to April 19, 1937. Rahu can bring spectacular material gain when strongly influencing in a chart. However, usually the gains are obtained through some form of manipulation which then turns out to be not durable. Such gains tend to be taken away, leaving those involved disillusioned. In the chart, Rahu is natally conjunct the most effective point of the 10th house, from where it afflicts also the 2nd house of wealth, the 4th house of fixed assets, the 6th house of debts and financial stability. Following the relatively auspicious sub-period of Mercury, the adverse sub-period of Ketu began on October 19, 1929, at a time when the transit nodes were afflicting their natal placements and houses. At that time, a sudden calamity erupted on the US stock market, ushering in years of painful adjustment in the economy.By comparison, the VENUS major period from April 19, 1996 to April 19, 2016, involves Venus as 4th lord located in the 6th house of the chart. As 4th lord Venus rules housing and as it is located in the 6th house, housing becomes enmeshed in debt. Moreover, as Ketu natally afflicts the most effective point of the 4th house and Rahu afflicts the 6th house, a crisis can develope surrounding housing debt, which burdens financial stability. This is consistent with the history of the present financial crisis. It had its roots in bad mortgage debts, which were massively issued and sold around the world during the Rahu sub-period from 2003 to 2006. In the sub-period of 6th lord Jupiter, many difficult transits have made financial market volatility pronounced, especially in 2008. As predicted, a crisis erupted in the Fall. The developments have almost been predicted on a day-by-day basis during the more intense transit afflictions, including the events in September.

Saturn sub-period ahead

The Jupiter sub-period ends on February 17, 2009 and the Saturn sub-period will begin. From late January to mid February 2009, as the Jupiter period is coming to an end, transit Jupiter will become conjunct with transit stationary Rahu at 15° Capricorn in the 7th house of the SAMVA USA chart. As Jupiter is debilitated in Capricorn, there may be more setbacks to financial stability in the USA at that time. From the outset, the Saturn period will be focused on reforms involving working people and basic production. The recovery from the Jupiter sub-period will be slow in coming, despite the policies and efforts of the Obama administration. This is because the major period of Venus is running, and it is placed in the 6th house. Moreover, as 8th lord Saturn rules obstacles and endings. As such, that sub-period, which last just over three years, will not be all that easy. Nevertheless, the reforms to the economy may be far-reaching and as such change the ground rules of the economic system in the USA.

.

Footnotes

[1] News report on gathering of G-20 leaders in Washington

No comments:

Post a Comment